32+ Imputed Interest Calculation

Rationale for imputed interest The tax code calls for imputed interest because some people and organizations have tried to dodge taxes by portraying large gifts additional compensation dividends and other taxable payments as. Imputed interest can also apply to loans from family and friends depending on the terms and value of the loan.

Imputed Interest Meaning Calculation Formula How Imputed Interest Works Youtube

Imputed interest is the estimated interest rate on debt rather than the rate contained within the debt agreement.

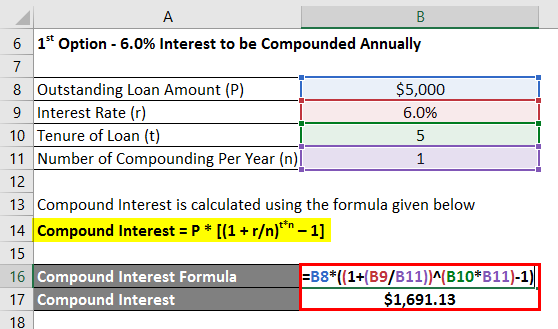

. Calculate the imputed interest income for tax purposes. 100 10 10 This interest is added to the principal and the sum becomes Dereks required repayment to the bank one year later. Web Imputed Interest refers to interest that is considered by the IRS to have been paid for tax purposes even if no interest payment was made.

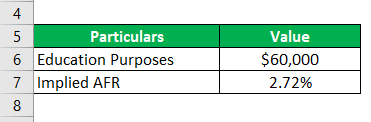

Imputed interest is used when the rate associated with a debt varies markedly from the market interest rate. Even though no interest was paid the parents would be responsible for declaring the imputed rate and paying taxes on it. Calculate the annual interest payable at the AFR.

Web Imputed interest is calculated according to the accretive method. Below-Market Loans Below-market loans occur when lenders charge below the minimum interest rate most common in cases of lending to friends and family. For example instead of paying interest checks some debt instruments increase the principal.

R is the annual rate. Web To calculate the imputed interest follow these steps. Easily calculate IRS state interest online with results that.

This formula is used to calculate the imputed interest by multiplying the principal amount by the annual rate and the term length. It helps identify the transactions that crystalize imputed interest. Web The Interest Rate Calculator determines real interest rates on loans with fixed terms and monthly payments.

In 1984 the Tax Reform Act set provisions for applicable. Web The concept of imputed interest refers to the calculation of interest that should have been paid for tax calculations even if there were no actual interest payments between the lender and the borrower. R is the annual interest rate in percentage.

Web March 28 2023 What is Imputed Interest. To payoff the amount due from 04152023 which gathered interest until 09212023 the amount required to be paid is. P is the principal amount.

Lets assume the AFR is 2 for this example. IRS Interest Rates Table. When a debt instrument pays no interest or very low interest the IRS computes the interest rate you should have gotten and taxes you on that phantom interest.

Step 1 Businesses frequently allow customers to pay for goods and services over time without specifically stating any interest charges. It increases the revenue of the IRS. Web To calculate imputed interest you can use the following formula.

Rates change every month. The rule applies to below-market loans that impose no interest or too little interest. They vary based on loan duration and compounding intervals.

The Types the Pros and Cons Plus How to Qualify. I P r100 t Where. The IRS uses imputed interest as a tool to collect tax revenues on loans that dont pay.

Web The difference600 - 20 580is imputed interest and you must report it as taxable income and pay taxes on it. I is the imputed interest. It makes the lenders to tax-plan in advance.

I represents the imputed interest. For example if the interest rate is 5 then I can buy 100 T-Bills for 95 each. Web Imputed Interest Calculation The basic premise behind imputed interest calculations for related party transactions is that any loan that an individual makes should receive at least the.

Web The revenue service would determine that the proper amount of interest paid would be 1400 100000 x 014 annually. This equals 50000 2 1000. Web Key Takeaways Imputed interest is interest the IRS assumes a lender has received.

100 10 110 Derek owes the bank 110 a year later 100 for the principal and 10 as interest. In this case it is 1000 annually. This is done to.

Here are a few common scenarios and their corresponding imputed interest formulas. Web The interest rate that is used is the rate applicable at the time of the loan and is generally fixed for the duration. In TValue you would just put U for the Nominal Annual Rate with the cash flows to solve for the imputed interest rate.

Its subject to taxation regardless of whether the lender has actually received it. Web Modified 5 months ago. T is the term length years.

Web I P r100 t. All interest income including imputed interest must go on 1040 line 2 taxable interest. Imputed interest helps identify fraudulent parties.

After 1 year I get 100 per T-bill so there is 5 imputed interest for each T-bill. P is the principal amount of the loan. They impute the interest.

No hidden surprises for lenders at the time of filing the tax return. Web The lender receives 50000 x 002 x 1 1000 in interest income to be declared on their tax return. Web To calculate the taxable portion of imputed interest for each tax year subtract the present value of the relevant payment from the gross payment amount.

The bottom line is you can solve for the imputed interest rate by using the cash flows over the term. It increases compliance with the IRS. Determine the AFR for the loans term.

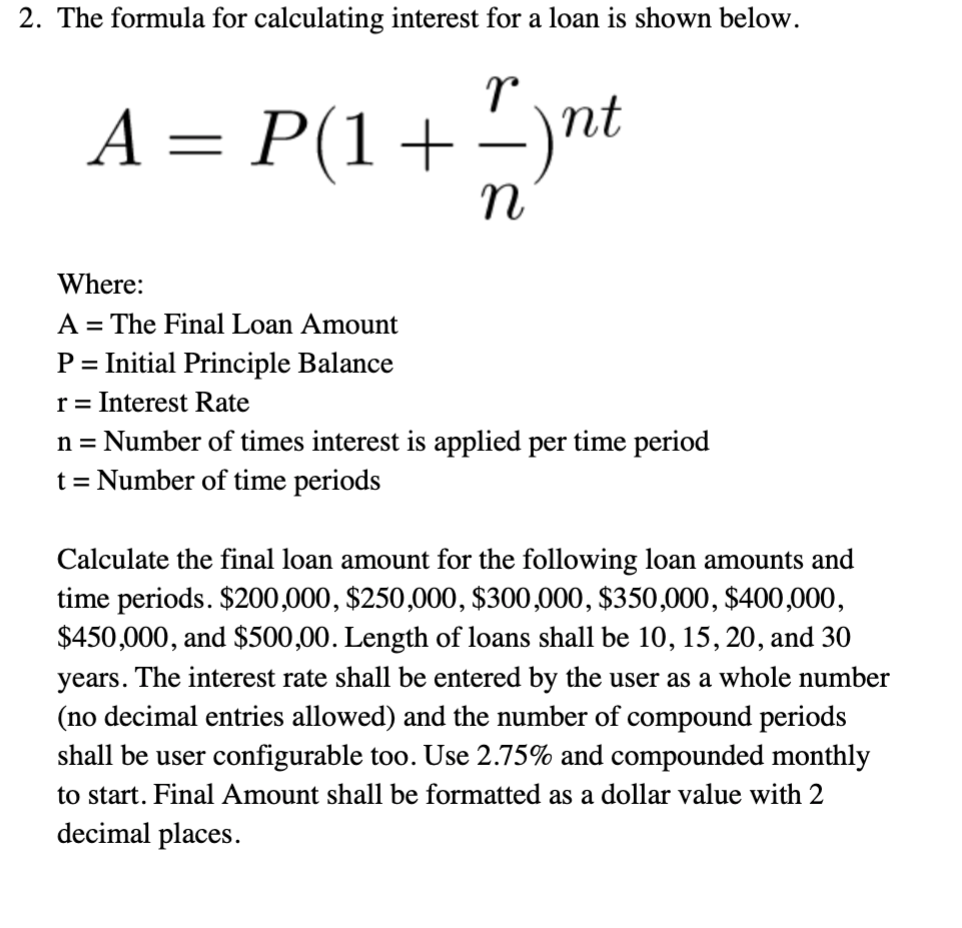

There are two scenarios in which imputed interest applies. Web To calculate interest. Web The formula for calculating imputed interest depends on the specific financial transaction and the prevailing market interest rates.

Web In this video on Imputed Interest here we provide you with definition working and benefits of knowing imputed interest𝐖𝐡𝐚𝐭 𝐢𝐬 𝐈𝐦𝐩𝐮𝐭𝐞𝐝 𝐈𝐧𝐭. Hence the name is imputed or implicit. Web When calculated your imputed interest rate would be 456.

For example it can calculate interest rates in situations where car dealers only provide monthly payment information and total price without including the actual rate on the car loan.

Excel Rate Function Exceljet

Imputed Interest Meaning Calculation Formula How Imputed Interest Works Youtube

Imputed Interest Types Of Imputed Interest Advantages

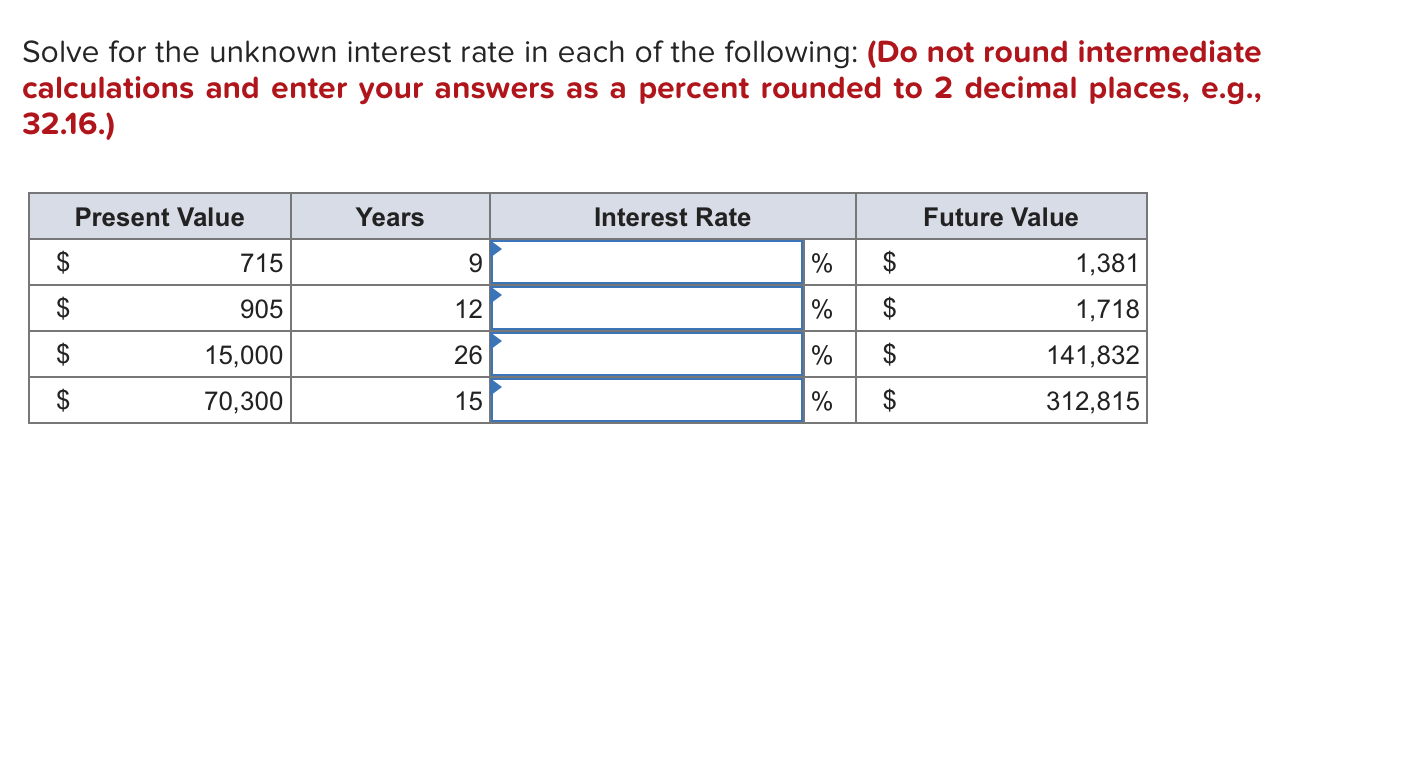

Solved Solve For The Unknown Interest Rate In Each Of The Chegg Com

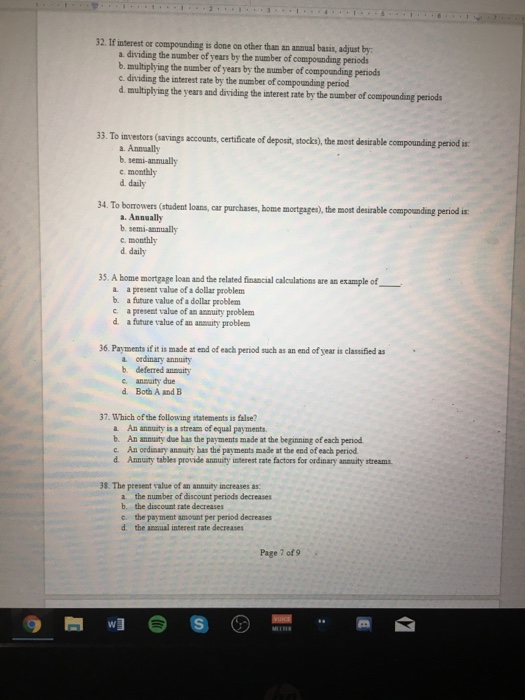

How To Calculate Bargain Rate Loan Imputed Interest Holden Moss Cpas

Solved 32 If Interest Or Compounding Is Done On Other Than Chegg Com

How To Amortize Imputed Interest

Susglobal Energy Corp Form 10 K Filed By Newsfilecorp Com

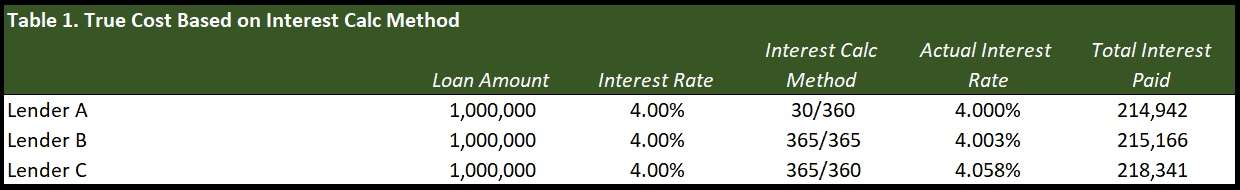

30 360 Actual 365 And Actual 360 How Lenders Calculate Interest On Cre Loans Some Important Insights Adventures In Cre

Robust Face Recognition Under Adverse Conditions

Imputed Interest Examples Reasons How It Works

:max_bytes(150000):strip_icc()/investing11-5bfc2b90c9e77c00519aa65f.jpg)

Imputed Interest What Is Is How To Calculate Faqs

Ruo2 Nanostructure As An Efficient And Versatile Catalyst For H2 Photosynthesis Acs Applied Energy Materials

Interest Formula Calculator Examples With Excel Template

:max_bytes(150000):strip_icc()/Pvif_4-3-v2_final-aea739afcbca439998b6fd4032af48bf.png)

Present Value Interest Factor Pvif Formula And Definition

Solved 2 The Formula For Calculating Interest For A Loan Is Chegg Com

:max_bytes(150000):strip_icc()/GettyImages-1419405893-ef45dd5e056c477ea8f0e22de10f424a.jpg)

Imputed Interest What Is Is How To Calculate Faqs